Overview

This is a public draft of our Fund 1 Memo as well as our future plans for Fund II. Will be updated as we learn new things and perhaps add a few more investments down the line. Stay tuned!

The UK/EU funding market is at a crossroads. While we have seen record levels of funding this past year overall, there has been a decline in pre-seed activity between 2018-2020. Underrepresented founders continue to struggle to fundraise, and moreover this endless pressure to take angel/VC money is not good for the startup ecosystem as a whole because it forces many slow-growing, profitable businesses into the “blitzscale” phenomenon when blitzscaling isn’t good for the majority of founders. Tyler Tringas from Calm Fund extrapolates the need for alternative capital models is due to several reasons:

There are stronger opportunities in the deployment stage for smaller, micro-SaaS businesses that fit narrow yet lucrative niches.

No-code tools means founders can build digital businesses much quicker, and coupled with new validation frameworks like pretotyping (pretend-prototyping), means the initial risk is smaller than ever.

Sustainably growing businesses will increasingly power the next generation of the UK/EU economy, and traditional SAFE-only investment models aren’t efficient or conducive for these types of entrepreneurs.

There is a massive gap in the market for funding before pre-seed, as many founders from poorer backgrounds struggle to receive friends and family funding and are forced to take either copious amounts of credit card debt or stretch their living expenses to the extreme.

Enter Horizan VC.

Horizan VC is an alt-VC Fund utilising the CFEA (convertible future earnings agreement) to invest in idea stage/friends and family founders on the lower end and pre-seed founders on the higher end. Future Earnings Agreements were originally developed for university students to have a creative way to finance their degree by paying a percentage of their future earnings if they got a job within their field that paid an income above a certain threshold. We partnered with Stepex to service our Future Earnings Agreements for startup investing because we believed that combining this instrument with a SAFE note would reduce downside risk for investors, capture equity upside, and get in earlier than every other angel investor/VC in the UK/EU.

To recap, here are our terms:

£10K-30K cheque sizes

Pay 10% of your monthly income if it’s at or above £2500 per month. Eg. Pay nothing if it’s not.

Repayment cap at 1.5x over 5 years or 2.0x over 10 years. If a founder receives qualified financing of £700,000 or more, your FEA gets cancelled and the SAFE gets activated.

At the Qualifying Round, Horizan's outstanding investment into the company will convert at a 20% discount to the valuation at that round. The Qualifying Round Valuation is defined as the price per Share paid by third party investors in the Qualifying Round. An example of the conversion is, if the Company is valued at £1,000,000 and Horizan VC has invested £30,000, then, Horizan VC will have 3.75% equity. If the Company is valued at £2,000,000 and Horizan VC invests £30,000, then, Horizan become a 1.875% equity partner.

If the Qualifying Round Valuation is greater than £5,000,000, Horizan's investment will convert at a valuation of no more than £5,000,000.

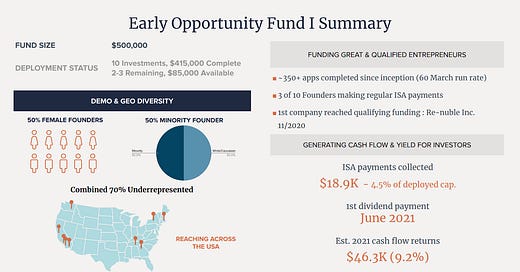

This model was pioneered in the USA by Chisos Capital, created by Will Stringer and Stephen Grinalds. To this day they still advise us. Over the course of their last $500,000 SPV, they invested in 10 companies, collected over $18,000 in FEA repayments, and had 1 company achieve qualifying financing (for them they set it at $2 million, rather than £700,000 for us). Currently they have raised over $500,000 from WeFunder for their Fund II and are well on their way to raising the $10 million they are hoping to accrue.

Projected Model Returns

https://docs.google.com/spreadsheets/d/1Db580DfYNkbjJ4jzYIeF2NQLJNrIzKcjFWxkRGN0Z0A/edit?usp=sharing

What we’ve learned from Fund 1

We have learned that our best deals came from accelerators, demo days, and investor to founder matching platforms rather than startup communities. Thus, over time we have shifted our dealflow sourcing strategy from startup communities to these aforementioned methods, though startup communities will always hold a place in our overall plans. Some of these organisations where we’ve sourced dealflow include Spice Startups, Swoop, City University Launch Lab, and Black Seed. To date, we’ve had over 50 people apply to receive investment from us, reflecting this breadth of reach and popularity.

From our own deals that have come through, there are 3 themes that influenced how we came to our decisions:

As online moves towards the metaverse, whatever it turns out to be, consumers are forecast to spend more time online in 3D worlds to socialise, work and play. There's a lot of activity taking place to accelerate this migration from the physical world to the digital realm, but also from the Web 2.0 world to the metaverse orientated realm of Web 3.0. This is why we invested in Kinicho; sensory interfaces like spatial audio are key to this momentum.

Buy Now Pay Later (BNPL) will play a massive future in consumer finance. Currently, modern day BNPL platforms are more focused on consumers purchasing quick, desirable items such as articles of clothing in installments rather than bigger goods such as furniture or fridges. BNPL solutions enable customers to feel less guilty about “nice to have” purchases since the payments are spread over time rather than all at once. In addition, many Gen Z adults are starting to stay away from credit cards due to the punishing interest rates on late repayments, thus creating even bigger markets for BNPL. There is still much scope for BNPL to be used in more industries and this is why we invested in GoCaptain- because driving lesson finance is a key industry that can be disrupted by BNPL.

Good old fashioned high-pain point problem solving. This is why we invested in ZIM Connections; they found a way to put the functionality of an eSIM onto a proprietary app, and then integrated an Amazon style marketplace for these eSIM plans so consumers can have great connectivity at market-rate. This saves time, mental energy and money when travelling, and enables holiday-goers and business trippers alike to focus more on their task at hand and/or enjoying their new digs.

We’ve also discovered that our unique investment team makeup influences how we evaluate deals. All of us having product and ecosystem experience means we can drill deep into whether a potential founder is building innovation that makes sense. Subsequently, this means that we end up turning down deals that look extremely good on the surface but without much substance, and we take on founders who have been rejected by lots of angels/VCs but we see some gold in them. One big example is how we chose to invest in GoCaptain even though many well known angel investors/VCs passed up on the team. We saw potential in the founders, and believed with our assistance and funding we could help take them to stratospheric heights. We really didn’t care that we were first cheque in; after all, this is what we specialise in.

In addition, entrepreneurs are drawn to us because we are authentic and we exude similar energy. As young, diverse, recent founders turned investors and ecosystem builders, we can sit down in the same room as these people, empathise with their struggles and find scrappy, product driven ways to solve them. In addition, due to our collective emotional intelligence, founders feel very comfortable being around our team, and we are able to have great conversations beyond business. For these reasons, founders feel they can be transparent with us with good and bad news, knowing that we will find ways to lead them through their challenges instead of berating them.

Meanwhile, we have proven that we can provide considerable value to these founders on a practical scale. Since 3 of our Investment Committee members (Toby Allen, George Quentin, Viraj Ratnalikar) are very passionate about low code, automations, and product development, we’ve all found ways to help our portfolio companies save time and money by showing them how to utilise tools such as Xano, n8n, and Integromat to make their operations more efficient. As all of us on the team have been well connected in the startup ecosystem, we’ve curated warm introductions to various investors, freelance marketing specialists, and legal support, all off of a 10-15% discount just for our portfolio. Through a combination of BuiltFirst and Secret, we’ve been able to curate a massive set of perks, ranging from AWS Credits, discounts on Airtable, and others.

How we are hoping to structure Fund 2

In borrowing Calm Fund’s model, we are hoping to go with an investor-subscription rolling fund (similar to the Angelist model) rather than a traditional 7-10 year fund cycle. These are the reasons we are hoping to do this:

This allows us to open the doors up to our fund for a wider range of LPs (including exited founders, other VCs, family offices, or professionals with some spare cash). Our goal is to have LPs in our fund who are risk-takers like we are and not afraid to put money into companies that don’t fit their initial form of mental pattern matching. Subsequently, this will shorten the fundraising process so we can deploy money into companies quicker.

This presents a more flexible arrangement for investors, because sometimes investor earnings can fluctuate from year to year. This allows investors to either increase or decrease their commitments every 4-8 quarters (depending on how long they commit for).

This will enable us to have a predictable cash flow per quarter, and thus be able to make timely hires, expenditures and investments when we need them (rather than having to wait for 1 giant lump sum of money that would last is 7-10 years).

Right now, investors are able to put soft commitments of minimum £5000 per quarter, with a minimum commitment of 4 quarters. We will take a 12.5% fund subscription fee each quarter to pay teammates and internal fund expenses rather than going through a classic 2/20 model. Our 12.5% fund subscription fee is a much better value than the 2/20 model simply because taking 2% each year from a fund equates to 20% total in a 10 year fund life cycle. We want to relentlessly align incentives with both our LPs and the founders in our portfolio that we serve, so this is how we landed on our figure of 12.5%.

With Fund II, keeping cheque sizes at a similar level, we aim to fund around 200-400 idea stage to pre-seed founders. This means that although we will still maintain some level of selectivity, we will gradually veer towards a little more of a Tiger Global type of model where we are able to spread our resources across a much wider selection of founders. This Fund II will truly enable us to democratize entrepreneurship by allowing us to fund a high volume of idea-stage to pre-seed founders in the UK/EU, and along the way build out proper mentorship and community-based programmes.

Early soft commit form here: https://airtable.com/shrsNUDJXUgOrFTKM. This is not financial advice or promotion, and any money put into this fund will be at risk.